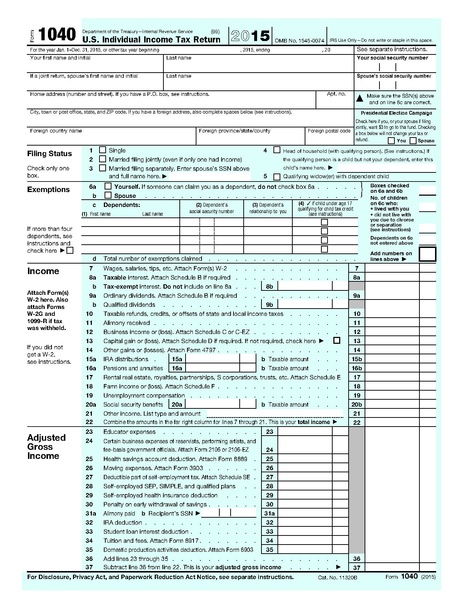

Various states in the U.S. are using big data tools, such as the Lexus-Nexus database, to identify people who are filing false tax returns. A recent posting at the Pew Trusts, indicates that “Indiana spotted 74,782 returns filed with stolen or manufactured identities as of the end of last month with its new identity-matching effort. Without it, the Department of Revenue caught just 1,500 cases of identity theft out of more than 3 million returns filed in all of 2013.”

The article goes on to outline other ways big data is being used by the states. This can include the focused (e.g., tax refund validation) use of third party data sets, or can include ways to span state data sets to surface “exceptions.” A state can cross check drivers license records with car registrations, property tax records, court records, etc., … to ultimately identify wrongdoers.

This hearkens back in my own family experience when my daughter was working for a catalog sales company. She was assigned the task of following up on “invalid credit cards” to get valid entries to allow the items to ship. She discovered via her own memory of contact data, that a number of invalid credit cards, being used with a variety of names, were going to a single address. She contacted the credit card companies to point out this likely source of fraud, only to find out that they incorporated the costs of credit fraud as part of their costs of doing business and were not interested in pursuing an apparent abuser. Big data, appropriate queries and a willingness to pursue abuse could yield much greater results than the coincidental awareness of an alert employee.

So … Here’s the Question(s) that Come(s) to my Mind:

- What are the significant opportunities for pursuing ne’er-do-well‘s with big data either by governments or by industry?

- What are the potential abuses that may emerge from similar approaches being applied in less desirable ways? (or with more controversial definitions of ne’er-do-well)?

JOIN SSIT

JOIN SSIT